MORTGAGE RESOURCES | T1 GENERAL

WHAT IS A T1 GENERAL?

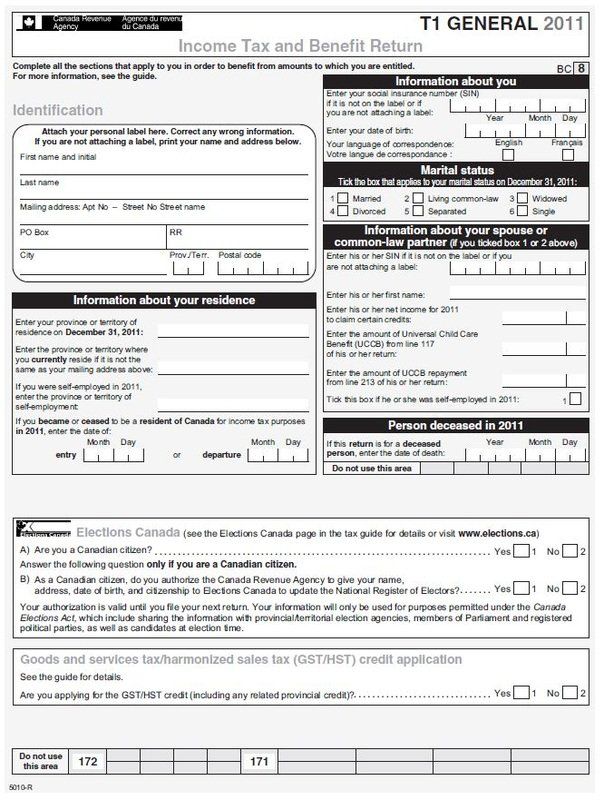

A T1 General Tax Return is typically a 4 page document used in Canada by individuals to file their personal income tax return. Individuals with tax payable during a calendar year must use the T1 to file their total income from all sources, including employment and self-employment income, interest, dividends, and capital gains, rental income, and so on.

After applicable deductions and adjustments, the net income and taxable income are determined, from which the federal tax and the provincial or territorial tax are calculated to give the total payable. Subtracting total credits, which include the tax withheld, the filer will either receive a refund or have balance owing, which may be zero. The T1 and any balance owing for each year are generally due by the end of April of the following year.

WHY DO LENDERS REQUIRE T1 GENERALS?

If you are self-employed, traditional lenders normally require 2 years T1 General Tax Returns to confirm that you are filing taxes as a self-employed individual and sometimes we can “add back” certain expenses into your income in order to better qualify you for financing.

WHERE CAN I FIND MY T1 GENERAL?

T1 general should be in your tax file but can also be received or completed through an accountant, tax company (ie H&R Block) or by the individual for submission of their personal taxes to Revenue Canada.

The information and services offered on this Site are provided with the understanding that neither Dominion Lending Centres Inc., nor its suppliers or users are engaged in rendering legal or other professional services or advice. Although we strive for accuracy, timeliness and completeness, information quoted is not guaranteed and may change at any time and the information you obtain at this site is not, nor is it intended to be, legal advice. If you require specific advice regarding your own situation please contact me for consultation.