Mortgage Deferrals Now Recorded on Credit Reports

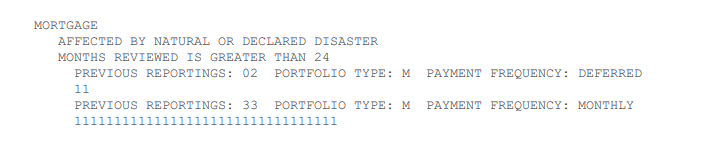

In this scenario, it shows that the mortgage was paid as agreed monthly for 33 months before being deferred for the last two months. It also shows that mortgage payments are currently in deferral.

Some may consider the credit bureau reporting a deferred status as good news. As COVID-19 hit like a freight train, many financial experts wondered about reporting errors on credit bureaus as a result of deferred payments. The fact that there is a system in place to report deferrals is a good sign.

Deferring your mortgage payment won't lower your credit score, but reporting errors from deferrals might. Once you've resumed your payments, it's a good idea to get a copy of your credit report to check for errors.

So, why does this matter to me now?

If you're considering a change to your mortgage, most lenders will be very hesitant to consider lending you new money when you aren't able to make your existing mortgage payments. This will be the case if you are looking to purchase a new property, renew, or refinance your current mortgage.

In fact, some lenders expect to see a history of regular repayment on any previously deferred loans before proceeding with any new application. Length of time after deferral varies by lender. This would include any debt payments (loan, line of credit, credit card) that have been deferred as well.

If changes to your mortgage are on the horizon, you need to have resumed all your regular debt payments before it will be possible to secure new mortgage financing.

If you'd like to discuss your personal financial situation with us, please contact us anytime!